Applying Expertise To Reach Portfolio Objectives

The creation of robust multi-advisor portfolios combines the arts of investment manager research and portfolio construction.

Our investment team has extensive experience in both alternative and traditional investment management, and long-established relationships throughout the investment industry that provide both a consistent flow of new ideas and a peer network in which to share research. And as a fully-independent investment advisor, we employ an open-architecture approach to access an unconstrained universe of potential managers and strategies.

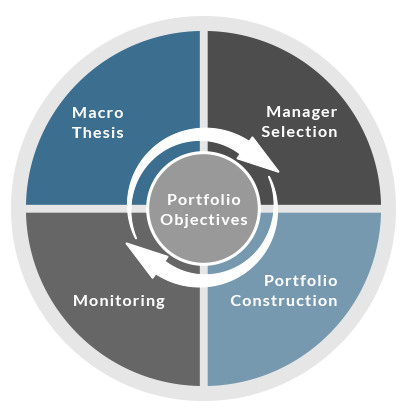

We begin by developing a macro thesis that considers the portfolio’s objectives in the context of the prevailing economic environment. We then identify investment managers that will execute the desired underlying strategies within the portfolio.

Effective due diligence is the foundation of the manager selection process. Before committing capital to an external investment manager, the manager must meet or exceed our high qualitative and quantitative standards. Approved managers are then carefully combined, using both qualitative and quantitative methods, to create robust multi-advisor portfolios that are capable of achieving their desired objectives.

Portfolios are continually monitored and evaluated to ensure that they are correctly positioned as the economic landscape changes.

The Investment Process

Our disciplined, risk-managed approach to investing yields portfolios designed to meet the specific needs of our clients.